The Mass Litigation Phenomenon Involving Llano Financing, Impac Funding and Others

It is very important that appraisers and appraisal firms – small and large – and also appraiser regulators understand a new mass litigation phenomenon that is affecting hundreds of residential appraisers in at least 10 states (so far).

Appraisers are being targeted in lawsuits by investment entities named Llano Financing Group, Mutual First, First Mutual Group and Carrington Capital Management; and behind these entities is Savant LG, aka Savant Claims Management, and its principals. As of this date, these entities have filed about 340 lawsuits against appraisers in 2014-2015. They are not banks, credit unions or any kind of regular financial institutions. They are investor-backed vehicles aiming to make money by suing appraisers. They acquire long-ago foreclosed loans for small fractions of the original principal amounts and then file lawsuits against the appraisers who performed appraisals years ago for the original lenders.

First Round. Although there were earlier sporadic cases, the first major round of mass litigation began in May 2014 with Mutual First and First Mutual filing more than 100 lawsuits against appraisers in Texas, California, Florida and New Jersey. So far, that round actually has been a spectacular failure, showing a lack of due diligence by the investors or their advisers — diligence that should have uncovered the operators’ track record of failure and the significant court judgments against them by prior unhappy investors in other ventures. I don’t follow every case filed by these investors, but I have looked closely at most and I have not seen a single case among the 100+ in the first round in which the investors actually recovered any money from an appraiser. In fact, as of this date, more than 90 of the cases filed Mutual First and First Mutual already have been dismissed by the courts. Many of those cases were dismissed even when the appraiser defendants didn’t show up to defend. According to court filings by First Mutual Group, the losing investors behind this entity were two British private equity firms: Alternative Capital Strategies LP and ACS General Partner Limited.

First Round. Although there were earlier sporadic cases, the first major round of mass litigation began in May 2014 with Mutual First and First Mutual filing more than 100 lawsuits against appraisers in Texas, California, Florida and New Jersey. So far, that round actually has been a spectacular failure, showing a lack of due diligence by the investors or their advisers — diligence that should have uncovered the operators’ track record of failure and the significant court judgments against them by prior unhappy investors in other ventures. I don’t follow every case filed by these investors, but I have looked closely at most and I have not seen a single case among the 100+ in the first round in which the investors actually recovered any money from an appraiser. In fact, as of this date, more than 90 of the cases filed Mutual First and First Mutual already have been dismissed by the courts. Many of those cases were dismissed even when the appraiser defendants didn’t show up to defend. According to court filings by First Mutual Group, the losing investors behind this entity were two British private equity firms: Alternative Capital Strategies LP and ACS General Partner Limited.

Second Round. Despite the losses and problems in the first round, there is now a second round of cases being filed by different investors – and this round needs to be taken more seriously. This round began in June in Florida and is being led by Llano Financing Group, which acquired the purported rights to sue appraisers from the same sources (Savant LG and/or Impac Funding). Like the other entities filing lawsuits, this is an investment entity, not a real lender, though its name might have been chosen to sound like a lender.

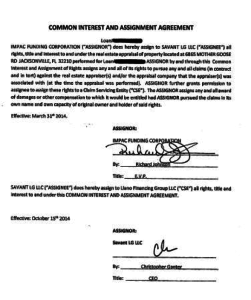

In most or all the cases filed by Llano in the second round, the original loans were funded or purchased by Impac Funding or a lender affiliated with Impac Mortgage Holdings. Impac then expressly assigned the rights to sue appraisers to Savant LG, who then re-assigned those rights to Llano (this is according to Llano’s own court complaints). In other words, Impac sold the claims against appraisers being pursued in these cases. An example assignment is included here — in the assignment Impac states that it “does hereby assign . . . any and all of its rights to pursue any and all claims . . . against the real estate appraiser(s) and/or the appraisal company.” (The legal validity of Impac’s assignments will have to be tested by appraisers in their defense.)

Another entity recently filing some of the lawsuits in this second round is Carrington Capital Management — which is apparently under the same umbrella of ownership as Carrington Mortgage. Both Llano and Carrington Capital are using different lawyers than in the first round. My estimation is that they lost confidence in the predecessors or did some due diligence regarding the backgrounds and experience of the parties with whom they were dealing.

These are the very latest developments in the second round of cases:

- In June-August 2015, Llano filed approximately 150 cases against appraisers in Florida over Impac’s loans – naming at least 250 appraisers and firms as defendants.

The heaviest concentrations of new lawsuits filed by Llano in August 2015 were in Illinois, where Llano filed more than 25 lawsuits in August (the screen image shows some of the recent cases filed in just Cook County), and in Arizona and Nevada, where it filed about 15 lawsuits in each state.

The heaviest concentrations of new lawsuits filed by Llano in August 2015 were in Illinois, where Llano filed more than 25 lawsuits in August (the screen image shows some of the recent cases filed in just Cook County), and in Arizona and Nevada, where it filed about 15 lawsuits in each state.- In connection with Impac’s loans, Llano alone has now filed over 210 lawsuits, naming more than 360 appraisers and appraisal firms as defendants. “Standing in the shoes” of Impact Funding, Llano has sued appraisers residing in Arizona, California, Colorado, Florida, Illinois, Indiana, Iowa, Nevada, New Hampshire and New Jersey.

- Aside from lawsuits, Llano also has turned to sending demand letters to appraisers, threatening to sue them or file disciplinary complaints to their state boards unless the appraisers pay money to Llano. So far, no appraisers have reported the actual filing of any disciplinary complaints by Llano or Impac — and most state boards would be loathe to consider complaints about 10+ year old appraisals filed by a party like Llano and likely would be more interested in disciplining any appraisers creating the non-complaint review appraisals Llano has procured to support its claims.

- Appraisers can see a few of the “review appraisals” filed by Llano in alleged support of its claims at: http://www.appraiserlaw.com/Pages/LlanoFinancingImpacFunding.aspx. The reviews used by Llano are nearly identical (some contain the same typos), are not supported by any real analysis and display gross violations of USPAP. And, for an unexplained reason, some of the reviews filed by Llano were allegedly prepared by “Faye Dunnaway.” While that is curiously the misspelled name of a famous actress, no licensed or certified appraiser with that name has yet been located — no such appraiser is on the Appraisal Subcommittee’s National Registry.

- In the first “test round” of nine cases that Llano filed in federal court in Florida and New Jersey in December 2014, Llano already has lost seven of those cases and the appraisers have been dismissed. In the new round of cases, it has tried to adjust its strategy by filing most of its recent cases in state courts using different lawyers and pushing slightly different, often inconsistent, legal contentions.

- If Llano’s new cases go forward, Impac’s own lending and appraisal practices will very much be “on trial” along with the appraisers. The reasons for this are threefold: Llano, as Impac’s assignee, is now “standing in the shoes” of Impac and the all of the defenses that would have applied to claims by Impac itself will made by the appraisers (an example assignment is shown to the right); Impac’s own mortgage and underwriting files, including its appraisal review, quality control and documentation, will be highly relevant information in each case; and Llano is claiming in the lawsuits, among other things, that Impac would not have funded or purchased the loans at issue in each case if the valuations had been “correct.” Attorneys representing defendant appraisers in these cases will soon be seeking documents and deposition testimony from Impac and its past and present personnel.

- Because of Impac’s willingness to sell/assign the rights to sue appraisers to an entity like Savant LG and the widespread litigation that has followed, appraisers are asking whether they should perform current appraisal work for Impac and its related lenders, such as CashCall, or for clients who sell or fund loans with them. Impac is the only lender/mortgage investor engaging in this practice on a widespread basis at this time.

I will be keeping appraisers up to date with more information in the future.