When it comes to growing your retirement savings, you may be wondering: What types of investment accounts should I use? And where should I locate them in order to utilize tax savings as much as possible? The real estate mantra “location, location, location” applies to retirement savings as well. Whether you’re a self-employed real estate appraiser or you work for a large company, here are some basic tips and guidelines on how to maximize your retirement savings.

Use tax-advantaged accounts

Perhaps the best way to save for retirement is through tax-advantaged investment accounts, such as:

- 401(k)

- Roth 401(k)

- IRA

- Roth IRA

- SIMPLE IRA

- SEP IRA

They all have specific factors for consideration, so review each one carefully.

For example, traditional 401(k)s and traditional IRAs are tax-deferred. That means you don’t have to pay income taxes on the earnings now, but you will pay taxes later. So, you get a tax deduction in the current year that you put the money in. The money then grows tax-deferred. And then when you take the money out in retirement, you will pay taxes based on the tax bracket you’re in.

On the other hand, with Roth 401(k)s and Roth IRAs, the qualified withdrawals are tax-free—provided that the account holder is at least 59-and-a-half years old and has held the account for 5 years. So the Roth does not give you the tax deduction in that calendar year, but the money then grows tax-free, and it’s withdrawn tax-free as long as you meet those two criteria.

Tips to get the most out of tax-advantaged accounts

Take advantage of a 401(k) or similar plan if it’s offered to you at work. Or, if you can set up a SIMPLE IRA or a SEP IRA at your work, take advantage of that.

Try to contribute the maximum. Each retirement savings plan has different amounts that can be contributed, based on the particular type of plan.

For IRAs, different rules apply to each type, so check with your financial professional to see which one may be best for you. But consider an IRA account for your retirement investment plan, too—in addition to your 401(k)—especially if you’re contributing the max to the 401(k).

In all cases, non-qualified early withdrawals will be subject to additional federal taxes.

Our Unlimited Learning Membership is your one-stop, money-saving solution for all CE plus professional development. Learn more.

Understand the 3 basic asset classes

Developing a well-thought-out investment plan will help you pursue your retirement savings goal. So now let’s review the basic asset classes. There are a number of ways to invest your money. Most investments can be classified in one of three asset classes:

- Stocks

- Bonds

- Money market instruments

How you divide your money among these choices is known as asset allocation. Each asset class has different risk and return characteristics. Even with one asset class, you’ll find choices with higher risk and higher return potential.

Asset allocation also may be able to help you reap the potential benefits of diversification—when one investment loses value, another may be holding steady or gaining. Asset allocation does not ensure a profit or protect against loss.

Understand your risk tolerance

The next step is to understand your personal risk tolerance. While stocks involve the greatest risk, over the long-term they can have the greatest return (as shown in the chart above). But past performance cannot guarantee future results. There will always be the chance that you could lose money in the stock market or even in the bond market. For example, back in 2008, just about every sector in the economy, every sector in the market—including bonds and stocks—lost money during that time.

Realize your time horizon

Your time horizon is very important in evaluating and choosing your asset allocation because it can help determine your risk tolerance. The longer your time frame, the more aggressive you may want to be.

If you are many years away from retirement (e.g., 10-15+ years), you may be able to withstand short-term drops in the value of investments. Therefore you may want to invest the majority of your money in stocks to pursue their higher return potential.

On the other hand, if you are nearing retirement (e.g., within 10 years), you may want to choose a more moderate or conservative investment mix. This may include a larger portion of bonds and money market instruments to strive for more stability in the value of your investments. Consider, however, that retirement could last 20 years or longer. For that reason, you may want to include some stocks in your portfolio as a potential hedge against inflation. You can expect inflation to be around 4%, for planning purposes.

Asset allocation examples

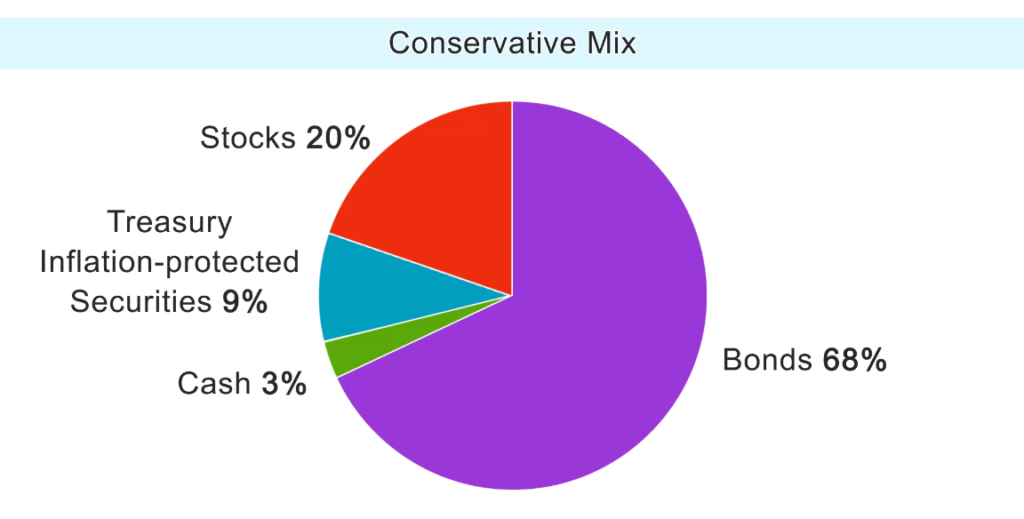

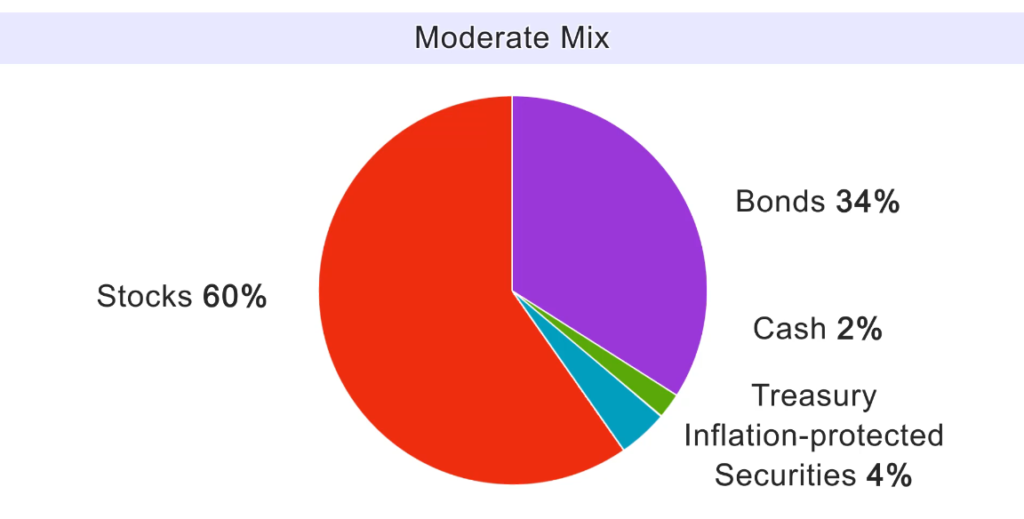

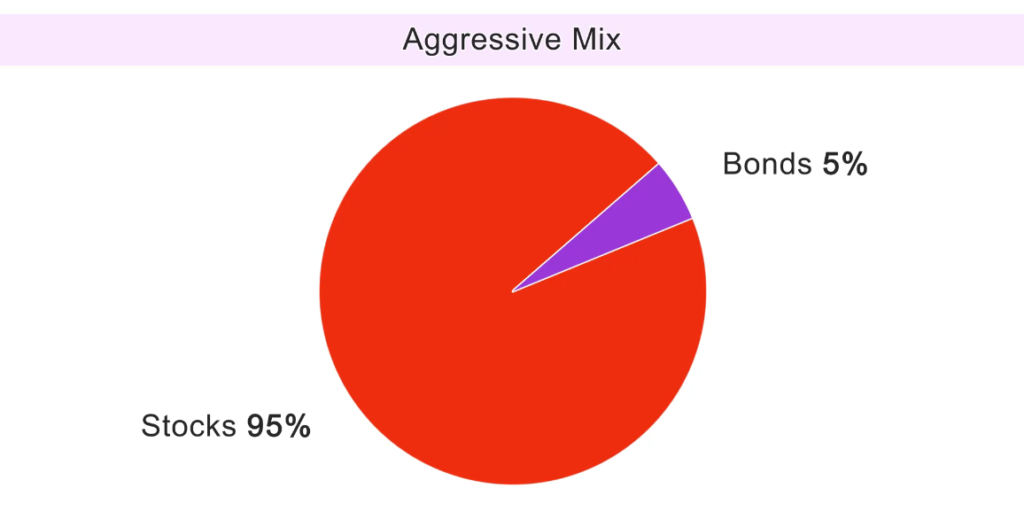

Here are three examples of asset allocation mixes to help give you a general idea of what your mix should look like.

A conservative asset allocation may be appropriate for someone nearing or in retirement. It includes a majority of bonds, in addition to some stocks, cash, and treasury inflation-protected securities (TIPS). TIPS are bonds issued by the U.S. Treasury that provide a hedge against inflation.

A moderate asset allocation (e.g., a 60/40 mix) may be appropriate for someone who’s nearing retirement in the next 5 years or so.

An aggressive asset allocation may be more appropriate for someone whose retirement goal is 10+ years away. 95% in stocks and 5% in bonds is a very aggressive mix, so keep in mind that this may not be the right fit for everyone.

Remember that your particular allocation of investments will depend on your individual retirement savings goals and other personal factors. Just because you’re 10+ years away from retirement, that doesn’t mean you need to have an aggressive mix like the third example above. Each person is different, and everyone has different needs and risk tolerances. It’s up to you to determine what mix is right for you.

Contribute to our blog! Apply here to reach thousands of readers on a weekly basis and establish yourself as a thought leader in appraisal.

The post Investment Tips: How to Grow Your Retirement Savings appeared first on McKissock Learning.